The emergence of cross-chain bridge development addresses the native isolation that limits the potential of separate blockchains. This article explores the imperative behind cross-chain bridge development, delving into the existing types and providing insights on how to select the most appropriate bridge for your project.

What Is a Cross-Chain Bridge

Cross-chain bridge development is a groundbreaking feature in blockchain tech, fostering interoperability among diverse blockchain networks. Acting as a technological link, these bridges enable smooth asset, data, or functionality transfers between different blockchains. Leveraging smart contracts, oracles, and consensus mechanisms, they ensure secure and trustless transactions. With the increasing interest, numerous bridges have surfaced, each with distinct features. To choose the right fit, project owners must grasp the fundamentals and align them with their project's requirements and objectives.

Why Cross-Chain Bridge Development Is Needed

Project owners encounter challenges related to interoperability, liquidity, and decentralized ecosystem efficiency. Cross-chain bridge development addresses these issues by:

1. Breaking Isolation: Facilitating interoperability between blockchains, allowing seamless asset and information transfer, breaking down silos.

2. Expanding Market Reach: Enabling projects to access users on different blockchains, broadening their market reach and potential user adoption.

3. Enhancing Liquidity: Allowing for smooth asset transfer between blockchains, improving liquidity for decentralized financial applications.

4. Standardizing Token Ecosystems: Providing a mechanism for translating and transferring tokens between different standards, promoting a cohesive token economy.

5. Fostering Community Engagement: Creating opportunities for collaborative communities by bringing together users from various blockchains, enhancing community engagement and interconnectedness.

By addressing these challenges, cross-chain bridge development empowers project owners to build a more versatile, interconnected, and user-friendly blockchain ecosystem, encouraging innovation and collaboration across multiple networks.

⚡️ Read the full article here!

Cross-Chain Bridge Development Types By Architecture

1. Multisig Bridges

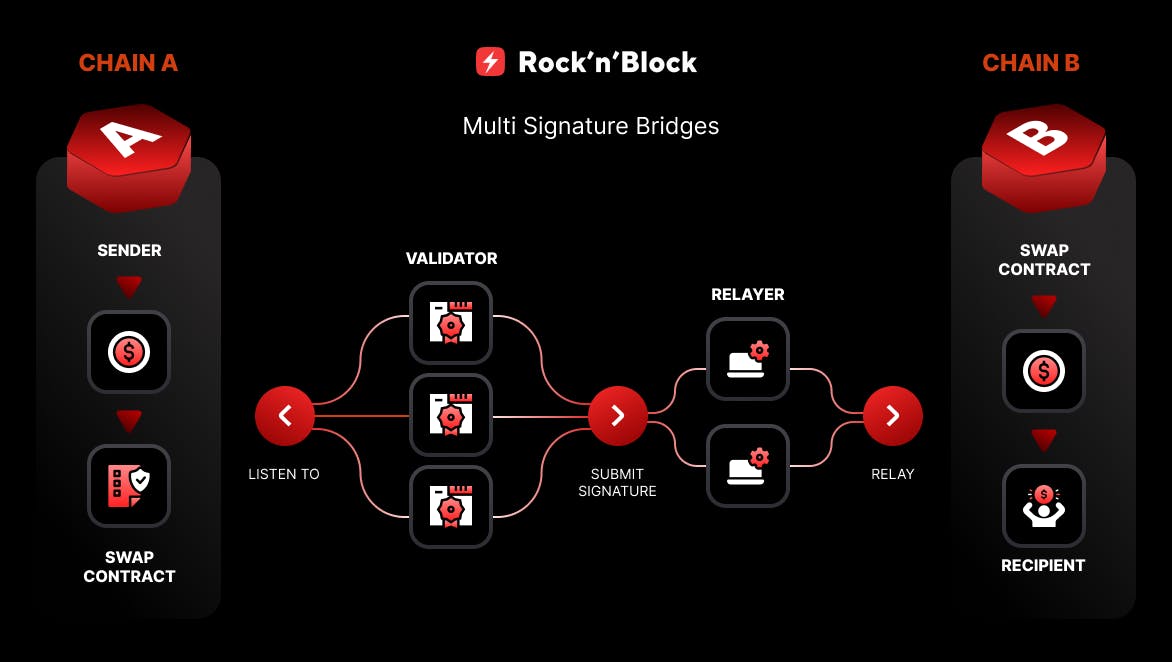

Multisig bridges utilize a multi-signature (multisig) approach, requiring multiple cryptographic signatures from validators for transactions to be executed. This enhances security and reduces the risk of single points of failure.

When a transaction occurs, tokens move from the user's wallet to the swap contract in the original network. Validators scan the original network's swap contracts for deposit events, collecting transaction data. The validator signs this data, passing it to the relayer. Once ⅔ signatures are received, the relayer triggers the transfer from the contract in the target network. Tokens stay locked in the original network's swap contract, while an equivalent amount unlocks in the target network and is sent to the user's wallet.

2. Proof of Authority Bridges

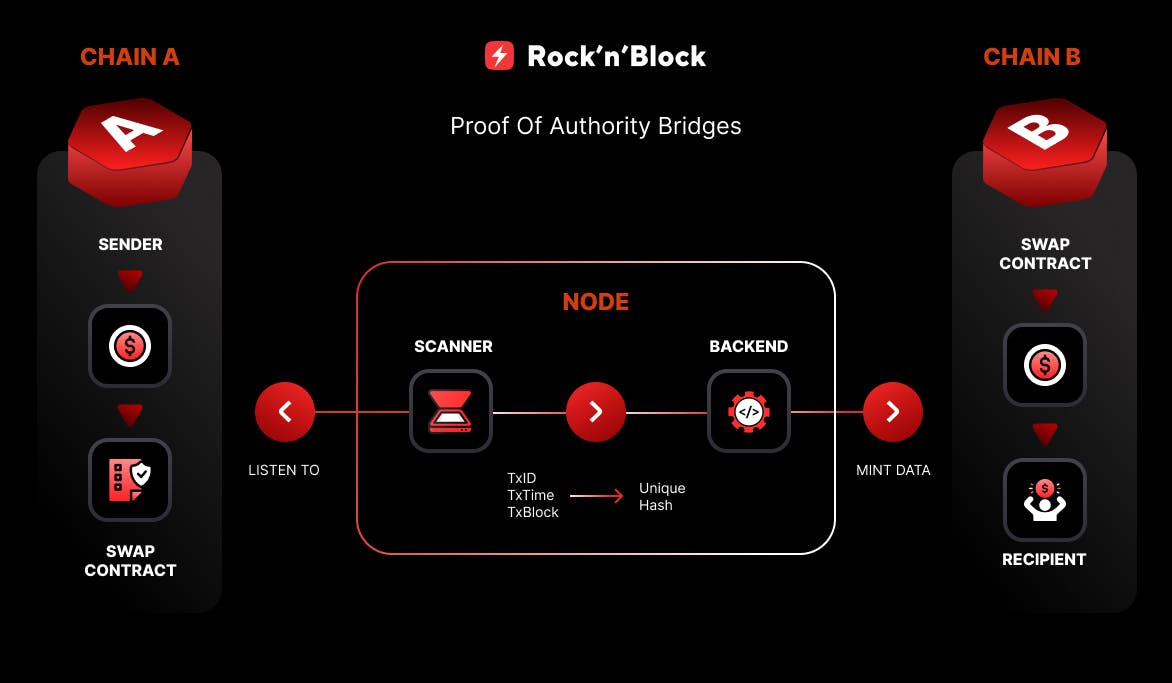

Cross-chain bridge development with Proof of Authority (PoA) ensures secure, non-custodial asset transfers. Trusted nodes validate data authenticity, with appointed node owners verifying incoming data. Users initiate transfers on the source chain (Chain A), locking tokens in a smart contract. A node collects and authenticates data, sending it to Chain B. On Chain B, a smart contract mints wrapped tokens using the received information, releasing them to the intended recipient.

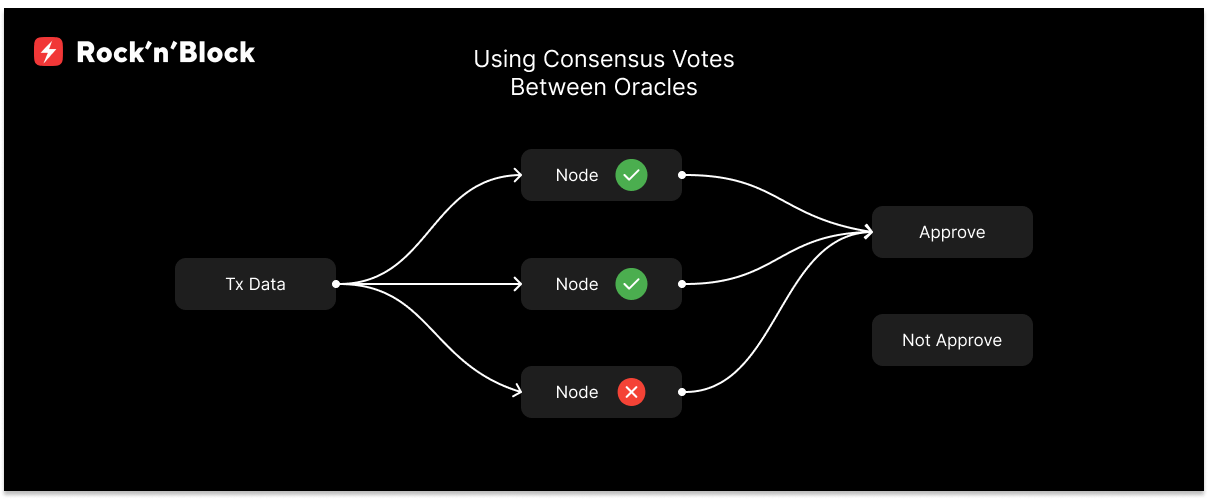

The PoA consensus algorithm ensures transaction correctness by relying on the reputation of oracles. Trusted node owners are appointed to verify the authenticity of incoming data. If more than 51% of these trusted voters confirm the data's validity, it is considered legitimate. This consensus mechanism adds an extra layer of security to the bridge's operation.

3. Atomic Swaps

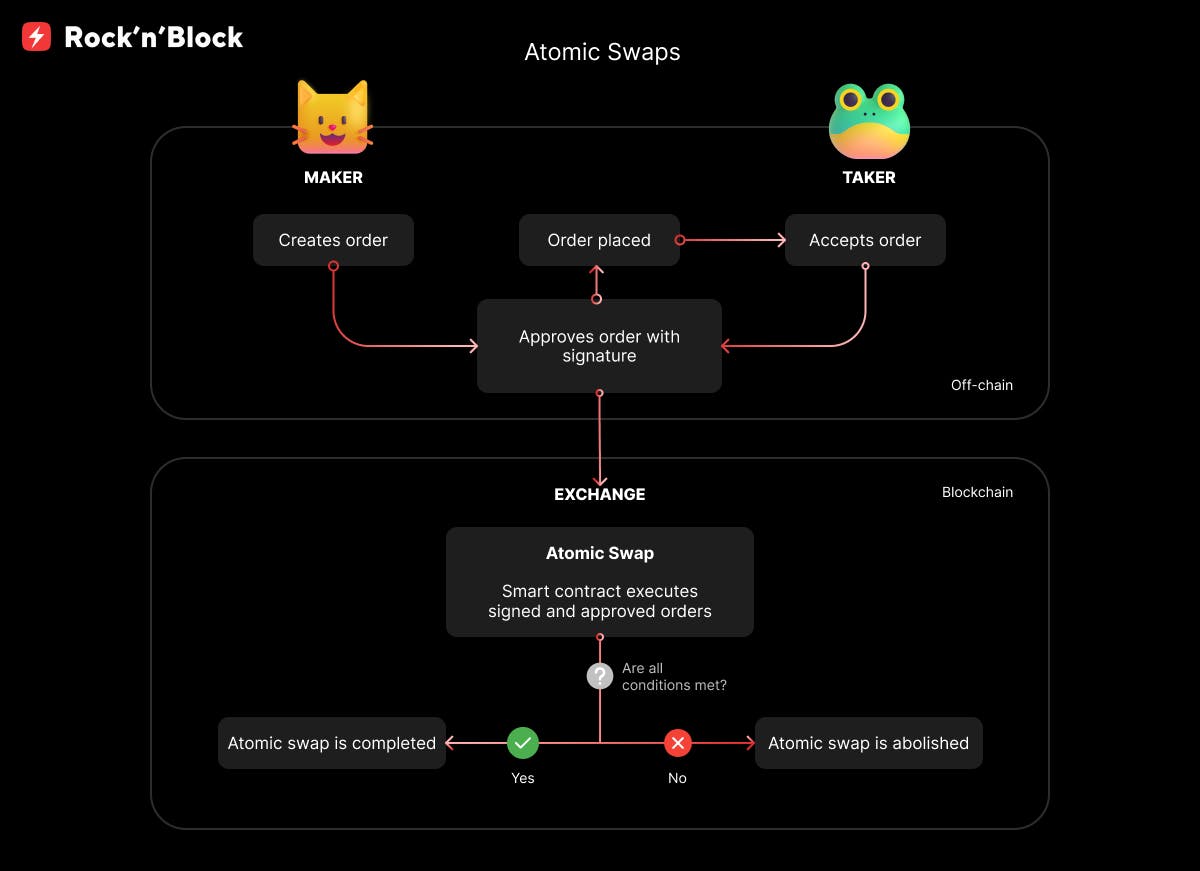

Atomic swaps, a key concept in cross-chain bridge development, facilitate trustless, peer-to-peer exchanges of different cryptocurrencies. This ensures that both parties receive the agreed-upon assets, or the transaction doesn't occur. The technical mechanism involves Hash Time Locked Contracts (HTLCs), a type of smart contract enabling conditional transactions. Each party generates a code, creating a hash shared with the other party. Funds are released when predetermined conditions, like revealing a secret cryptographic hash, are met. Simultaneously, both transactions are relayed to their blockchains. The recipient claims funds by revealing the pre-image (code) corresponding to the hash. If either party fails to claim funds, the other can reclaim theirs.

4. Bridge Aggregators

Cross-chain bridge development in the form of bridge aggregators acts as a platform connecting multiple existing bridges, establishing a network for cross-chain transactions. These aggregators integrate with various cross-chain bridges, spanning multiple blockchain protocols. Users initiate transactions on the aggregator platform, which determines the optimal route for the exchange through interconnected bridges, facilitating cross-chain asset transfers. Additionally, bridge aggregators may aggregate liquidity from different sources, enhancing the overall liquidity pool available for users on the platform.

Cross-Chain Bridge Development Types By The Principle Of Token Issuance

1. Lock and Mint/Burn Cross-Chain Bridge Development

Lock and mint cross-chain bridges facilitate secure asset transfers from one blockchain to another by locking assets on the source blockchain and minting corresponding assets on the destination blockchain. This approach allows users to seamlessly move assets between different blockchain networks.

The technical mechanism involves users initiating a transaction to lock assets on the source blockchain, typically involving sending them to a smart contract or a specific address. This ensures temporary custody. Subsequently, the minting process occurs, where the locked assets' representation, known as Wrapped Tokens, is created on the destination blockchain, following the transfer of transaction data to the target network swap smart contract.

2. Burn and Mint Cross-Chain Bridge Development

Burn and mint cross-chain bridges facilitate asset transfers between different blockchain networks by burning assets on the source blockchain and minting corresponding assets on the destination blockchain.

Users initiate a transaction to burn a specified quantity of assets on the source blockchain, irreversibly destroying them through smart contracts or specific protocols. Once the burning process is confirmed, the bridge on the destination blockchain is notified, and an equivalent amount of assets is minted, representing the burned assets. To prevent mismatches, these bridges maintain a synchronization mechanism to ensure the simultaneous occurrence of the burning and minting processes on both blockchains.

3. Lock and Unlock Cross-Chain Bridge Development

Lock and unlock cross-chain bridge development facilitates secure asset transfers between different blockchain networks. This bidirectional movement involves users initiating a transaction to lock assets on the source blockchain, securing them in a smart contract or specified address.

Once the locking process is verified, the bridge on the destination blockchain is notified, unlocking the corresponding assets for users to access and utilize, ensuring a synchronized and secure process.

The suitability of these cross-chain bridge types depends on the specific requirements of the platform or application. Lock and mint, burn and mint, and lock and unlock bridges offer distinct advantages, and the choice should align with the platform's use case, desired speed, and the importance of total supply consistency.

Conclusion

As the blockchain ecosystem grows, the ability to seamlessly connect and collaborate across different blockchains will help shape the future of decentralized technology. To achieve effective cross-chain integration, it is important not only to overcome technical challenges, but also to embrace the collaborative spirit that these bridges foster. By understanding the basics of cross-chain bridge development, embracing the variety of bridge types, and making informed decisions, you can effectively navigate the cross-chain landscape, opening up new opportunities for innovation and collaboration in the decentralized space.